tax benefit rule examples

Jones recovers a 1000 loss that he had written off in his previous years tax. Example of the Tax Benefit Rule Mr.

Chapter 2 Income Tax Concepts Kevin Murphy Mark Higgins Ppt Download

Significant tax savings can be obtained by understanding recognizing and applying the tax benefit rule.

. In the above example the taxpayers AGI was reduced by 24323. In one example described in the ruling a single taxpayer itemizes and claims deductions totaling 15000 on the taxpayers 2018 federal income tax return. View Notes - tax benefit rule examples from TAXA 3300 at Baruch College CUNY.

If a taxpayer takes a deduction in one year but recovers in a subsequent year some or all of the amount that gave. Amount of standard deduction - Head of household. The building is a total loss.

A tax benefit is a provision that allows taxpayers to pay less in taxes than what they would owe if that benefit were not in place. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be. One example of a situation covered by the tax benefit rule would be if a business listed an unpaid debt as an expense lowering its taxable income then recovered the money in.

The tax benefit rule is straightforward at least on paper. A tax benefit is any tax advantage given by the IRS to a taxpayer that. This represents the total amount of state income tax withheld from your wages in 2012 from.

The tax benefit rule is frequently overlooked yet in just a few minutes it can save taxpayers money. Tax benefit rule noun Legal Definition of tax benefit rule. Amount did not reduce the amount of tax imposed by Chapter 1 of the Code.

For example a tax credit for qualified. If a taxpayer for example claimed as a business expense. For example - you deducted 1000 in state income taxes on your 2012 Schedule A.

Recoveries of deductions claimed in previous tax years must be included in gross income in the year they are received. Suffers a fire a few days after completion of a building that cost 500000 to build. 540 - tax refund from 1099-G 2.

Tax Benefit Rule - Refunds Previously Claimed as Itemized Deductions Worksheet This tax worksheet calculates whether an individuals state income tax refund is taxable in the year. Total itemized deductions 3. The rule is promulgated by the Internal Revenue Service.

Explain The Tax Benefit Rule With Examples 1. Acmes insurance company refuses to pay the claim. Section 111 partially codifies the tax benefit rule which generally requires a taxpayer to include in gross income.

Tips To Use Tax Benefits That Are Available On Home Businesstoday Issue Date Jan 01 2015

Tax Deduction Definition Taxedu Tax Foundation

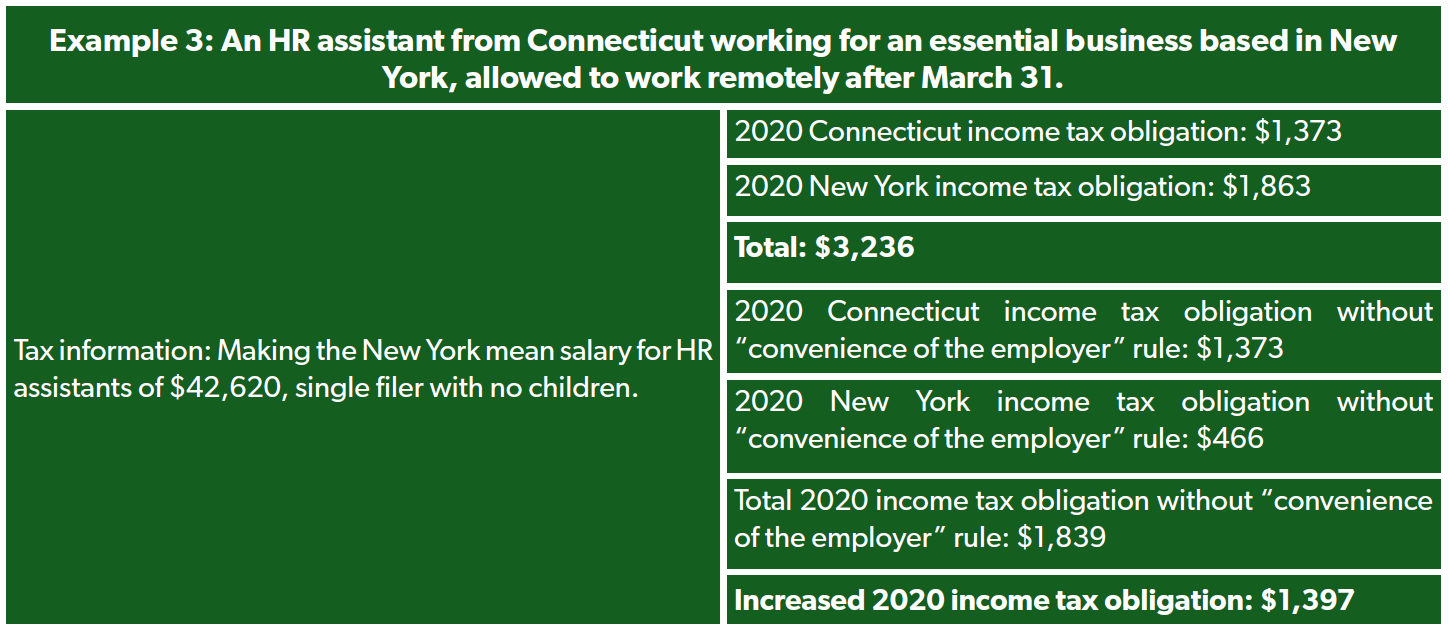

New York S Aggressive Pandemic Tax Strategy Underscores Need For Congressional Action Foundation National Taxpayers Union

Tax Exempt Meaning Examples Organizations How It Works

61 Gross Income General Concepts And Interest Flashcards Quizlet

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

Annuity Taxation How Various Annuities Are Taxed

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

/washsalerule-Final-19587138ed7544388995cbc67e83d4bb.png)

Wash Sale Rule What Is It Examples And Penalties

Section 179 Tax Deduction For 2022 Section179 Org

What Is The Standard Deduction Tax Policy Center

Amazon Com Every Landlord S Tax Deduction Guide 9781413325683 Fishman J D Stephen Books

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Learn More About A Tax Deduction Vs Tax Credit H R Block

Tax Benefit Rule Ppt Powerpoint Presentation Show Model Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Simplifying The Accounting For Income Taxes Under Asc 740 Gaap Dynamics